Term Insurance

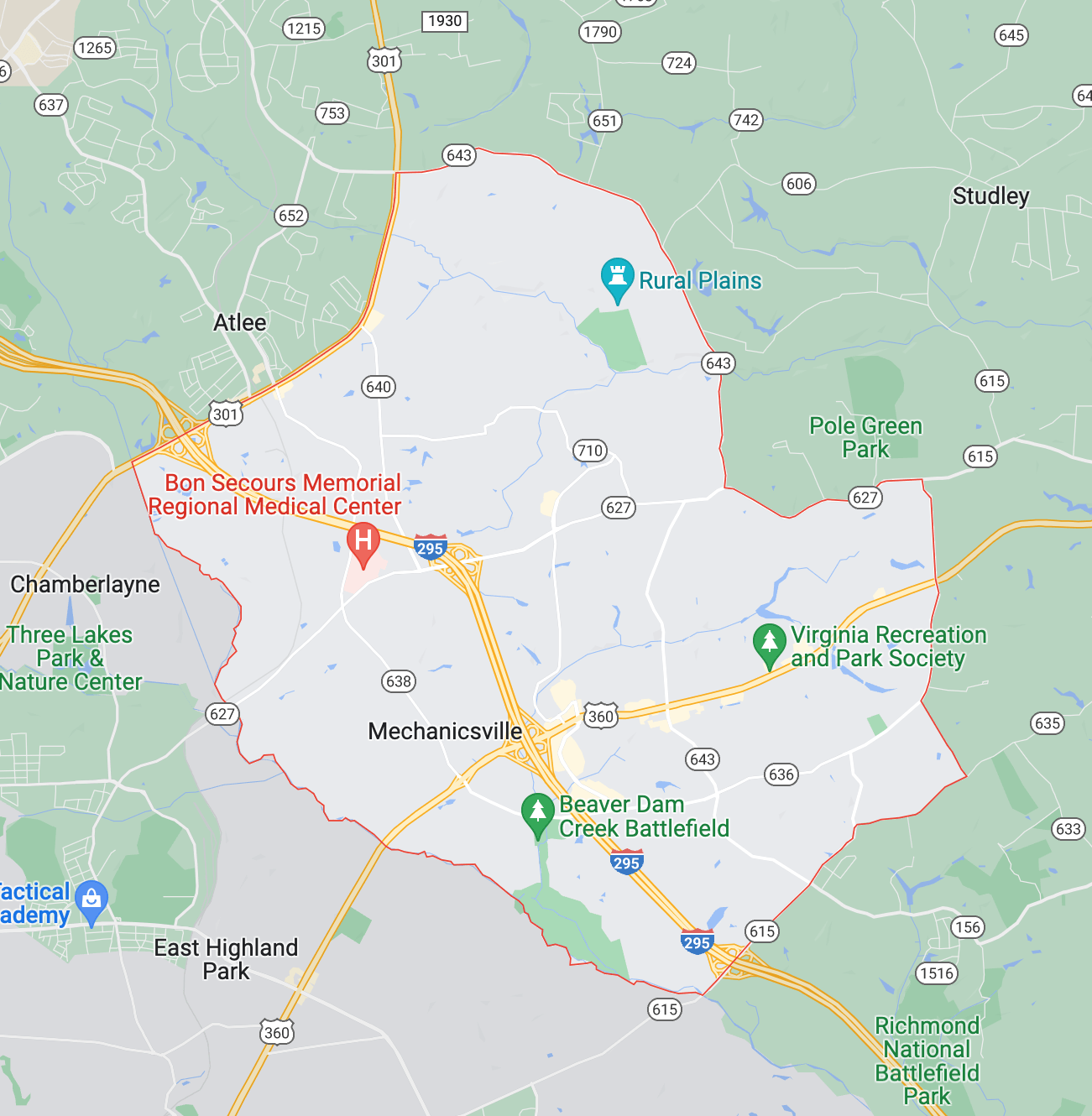

Serving

Mechanicsville, VA

With Pride

Working with a Local insurance agency offers a personal touch. Our friendly staff are based in the area and are quick to answer inquires. If you prefer doing business in person rather than over the phone we're here!

Why the Need?

Term Insurance can provide the following benefits to

- High Sum Assured at Affordable Premium

- Easy to Understand.

- Multiple Death Benefit Payout Options.

- Additional Riders.

- Income Tax Benefits.

- Critical Illness Coverage.

- Accidental Death Benefit Coverage.

- Return of Premium Option.

Contact Us

We will get back to you as soon as possible.

Please try again later.

Insurance FAQs

-

What are the different types of life insurance?

Life insurance comes in three basic types, whole life, universal life—also known as UL—and Term. Each of those types has multiple modifications, depending on the company. Thus, while we can educate you here, it is still important to work directly with a licensed representative of a company of your choice. The company is not legally responsible if you purchase a contract that contains clauses you did not understand. It is your responsibility to understand the type of insurance you purchase as well as any particular variations created by the company.

-

What type of life insurance is best for me and my family?

The type of insurance you need depends both on your current needs and on your future goals. If you are putting money aside for retirement and have plans in place for final expenses, you may only need a policy that would provide for your family while the children are young. In that case, a Term policy would be fine. If, however, you want some choices in the future, including the possibility of cash that can be added to your retirement assets, you should consider an Annuity.

-

Why do people buy Life Insurance?

While this question may seem like it has an obvious answer, many people wait too long to purchase term insurance and then can only afford enough to pay final expenses. The real purpose of term insurance , however, is to ensure that the people you love will be able to go on living—without undue hardship—in the event of your untimely death. It takes a spouse about three years to recover financially, rearranging bills and adjusting to one paycheck, after a partner dies. If children are involved, the adjustment takes an average of five years if both partners had received an income. If one parent had a lower income or had been staying at home to raise the children, that individual will have to go out and find work. The work is often service work of an unskilled nature. Thus, his/her income will need to be supplemented at least until the children are grown.

People who have significant wealth to the point that life insurance is not a necessity often purchase term insurance as a legacy, intending for the proceeds to benefit a charity or provide an education for grandchildren. It can also provide a means of keeping a business going if the key person dies, or a way for heirs to pay taxes on a large estate.

Owning enough term insurance to completely provide for your family may sound like an impossibility. However, with the right kind of policy and thoughtful financial planning, it isn't as difficult as you may think.

Want more information?

Business Hours

- Mon - Sun

- -

Pitcher Financial Services