Life Insurance

Life Insurance

Missy J.

Sadly, Missy J’s first encounter with life insurance came at age 14 when it paid for her father’s funeral expenses. Her next encounter came all too quickly. A year and a half later her mother was diagnosed with cancer and died soon afterward.

Missy, now 26 and wise beyond her years, when asked about her experiences, said, “You can’t take for granted tomorrow’s going to come. You have to make sure your future is safe.”

Today, Missy teaches second grade in West Bend, Wisconsin and is preparing for married life with Ryan, her high school sweetheart. Her parent’s decision to place the insurance benefits in a trust fund paying out periodically has provided in many ways. While in college, it helped pay her educational expenses and living costs and recently, it covered a down payment for her condo. Missy gratefully shares, “I own a home, a car, have a great job and a wonderful future husband all because my parents planned ahead. It was just exactly what my parents would have wanted.”

To read the complete story and more testimonies on Life Insurance, please visit www.life-line.org.

Serving

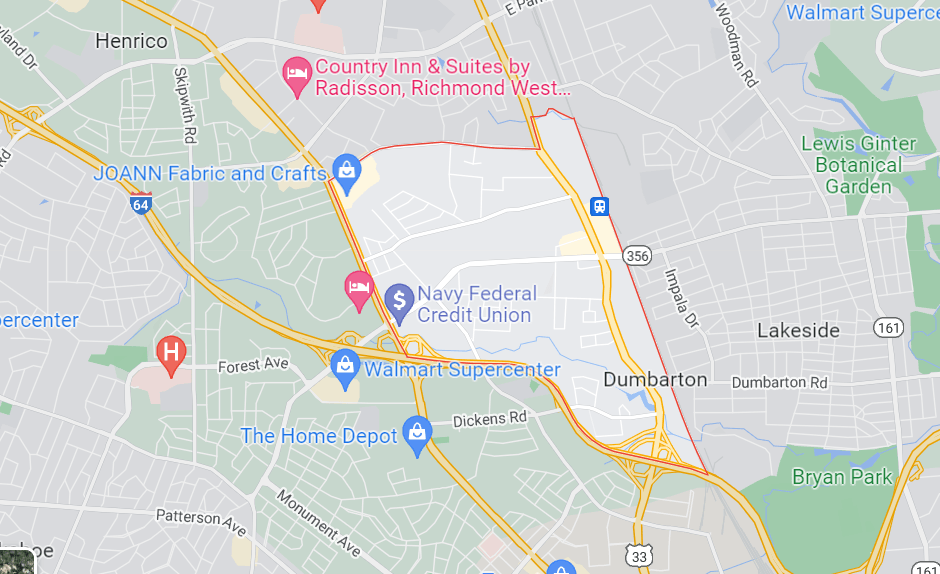

Dumbarton, VA

With Pride

Working with a Local insurance agency offers a personal touch. Our friendly staff are based in the area and are quick to answer inquires. If you prefer doing business in person rather than over the phone we're here!

Why the Need?

Life Insurance Usages

- Income replacement

- Mortgage

- Outstanding debt

- College education

- Offset lost retirement benefit

- Emergency fund

- Final expense

- Pay estate taxes

- Fund trust for child with special needs

- Business continuity planning

Contact Us

Insurance FAQs

While this question may seem like it has an obvious answer, many people wait too long to purchase life insurance and then can only afford enough to pay final expenses. The real purpose of life insurance , however, is to ensure that the people you love will be able to go on living—without undue hardship—in the event of your untimely death. It takes a spouse about three years to recover financially, rearranging bills and adjusting to one paycheck, after a partner dies. If children are involved, the adjustment takes an average of five years if both partners had received an income. If one parent had a lower income or had been staying at home to raise the children, that individual will have to go out and find work. The work is often service work of an unskilled nature. Thus, his/her income will need to be supplemented at least until the children are grown. Life insurance can help families financially recover from a loss.

Owning enough life insurance to completely provide for your family may sound like an impossibility. However, with the right kind of policy and thoughtful financial planning, it isn't as difficult as you may think. We can help you find the best life insurance policy for you.